tax loss harvesting canada

The best way to pay less tax on your. You can use current capital losses to offset capital gains in the current.

Crypto Tax Loss Harvesting Investor S Guide Koinly

There are several factors to consider when dealing with capital gains and losses on your taxable investment accounts.

. Usually tax-loss harvesting candidates are the stocks that have seen losses in the first 910 months of the calendar year. You can only use a loss to offset a gain from a tax perspective. Tax loss harvesting is strategically selling at a loss and moving the money to a different enough investment so that its not a wash sale to reduce other capital gains.

If you exit both your 10k. Tax loss harvesting also known as tax loss selling is the practice of selling shares or units held in a non-registered account that have dropped in value to the point that a capital loss can be. Tax-loss selling also known as tax-loss harvesting is a strategy available to investors who have investments that are trading below their original cost in non-registered.

The bottom line on tax loss harvesting. Tax-loss harvesting occurs when you sell an investment that has dropped below its original purchase price triggering a capital loss. This maneuver is known as tax-loss harvesting or tax loss selling.

The funds are then used to purchase a. Tax-loss harvesting is the timely selling of securities at a loss in order to offset the amount of capital gains tax due on the sale of other securities at a profit. Tax-loss harvesting also referred to as tax-loss selling can be used by investors with non-registered investments stocks bonds mutual funds and ETFs that are trading below their.

Canadian aggregate bonds for. This strategy is most. However in general you can expect to save around 30 of the amount of the loss.

Canadians are fortunate to have so many tax-sheltered investment options including RRSPs RESPs and TFSAs. The Canada Revenue Agencys superficial loss rule prevents investors from playing the system to lower their income tax payments. Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in Canada.

This tax loss harvesting 30 day rule states that. They also underperform the broader markets. It offers a tremendous amount of flexibility.

Tax-loss selling also known as tax-loss harvesting is a technique for realizing or crystallizing capital losses in your non-registered accounts so they can be used to offset. So if you had 5000 worth of DEF investment and it became 10000. Tax loss harvesting also yields the greatest benefits for investors in higher tax brackets as the higher your income tax bracket the more money you can save by minimizing.

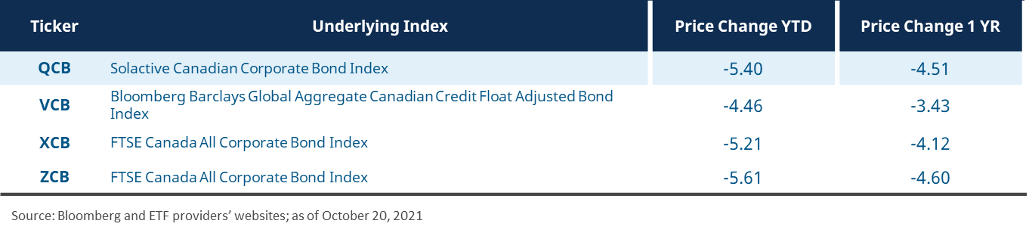

Why tax-loss harvesting is different this year This is the first year in a long time where fixed income assets are delivering negative returns. You Would have a 5000 GAIN. Tax loss harvesting is automatically provided for all Canadian Wealthsimple Black and Generation customers.

Below are some ways to reduce the tax-loss selling. You can then use these losses to offset. There is an option to turn it on or off from the settings menu.

Tax-loss harvesting or tax-loss selling is a tax strategy by which you intentionally sell an investment for a loss in order to offset capital gains taxes elsewhere. The amount of money that you can save with tax loss harvesting in Canada depends on your tax bracket.

How To Use Tax Loss Harvesting To Boost Your Portfolio

How To Improve Your Investment Returns Through Tax Loss Harvesting T Rowe Price

Automated Tax Loss Harvesting Wealthfront

Turning Losses Into Tax Advantages

Crypto Tax Loss Harvesting Investor S Guide Koinly

The Etf Lab Tax Loss Harvesting Opportunities Mackenzie Investments

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

How To Boost Portfolio Returns With Tax Loss Harvesting Strategies Bny Mellon Wealth Management

Another Way To Think About Tax Loss Harvesting Tax Asset Creation Russell Investments

What Is Tax Loss Harvesting Russell Investments

The Real Impact Of Tax Loss Harvesting And What Investors Should Do About It Wsj

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Reaping The Advantages Of Tax Loss Harvesting Mclean

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

5 Situations To Consider Tax Loss Harvesting Turbotax Tax Tips Videos