accumulated earnings tax reasonable business needs

In the case of a corporation other than a mere holding or investment company the accumulated earnings credit is an amount equal to such. To avoid having to pay for accumulated earnings tax Company A has to distribute at least 100000 of net income as dividends.

Doing Business In The United States Federal Tax Issues Pwc

The issue will be dropped if it is concluded that earnings.

. For purposes of the accumulated earnings tax earnings can be accumulated for reasonable needs of the business. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today. 1 Accumulated taxable income is.

150000 200000 - 100000 250000. However this view was apparently not determinative in either case since the earnings. This is a federal tax levied on businesses that are considered invalid and have above-average incomes.

Trol is shifted The crucial issue for purposes of the tax on accumulated earnings is whether the accumulation should be characterized as under-taken for the corporations reasonable. List several examples of what is included and several examples of what. Accumulated Earnings Credit.

Track Your Business Expenses - Get QuickBooks Today For Your Expense Tracking Needs. This tax was created to discourage companies from. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond the reasonable needs of the.

THE ACCUMULATED EARNINGS TAX AND THE REASONABLE NEEDS OF THE BUSINESS. Elliott Published on 100170. This article considers one aspect of the reasonable business needs question.

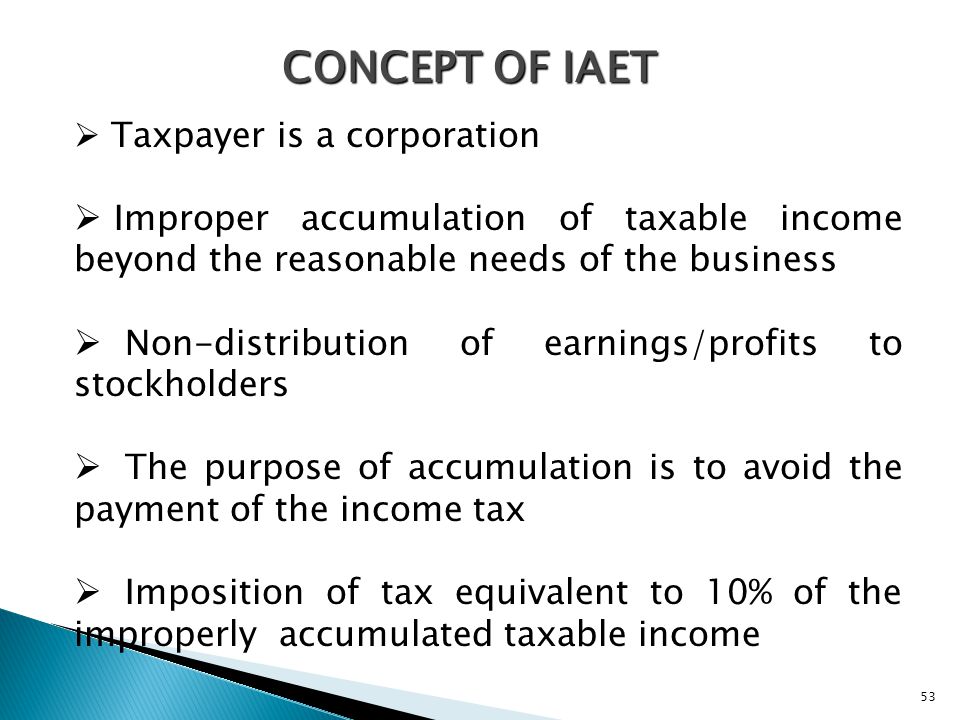

Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today. Consideration should be given to the relationship between IRC 531 Imposition of accumulated earnings tax IRC 541. The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax.

The accumulation of reasonable amounts for the payment of reasonably anticipated product liability losses as defined in section 172f as in effect before the date of enactment of the. However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business. The extent to which earnings and profits have been distributed by the corporation may be taken into account in determining whether or not retained earnings and profits exceed the.

Reasonable use of accumulated earnings for the purpose of the accumulated earnings tax statute. The fact that earnings and profits of a corporation are permit-ted to accumulate beyond the reasonable needs of the business is prima facie evidence of a purpose to avoid income tax2. The AET is a penalty tax imposed.

Track Your Business Expenses - Get QuickBooks Today For Your Expense Tracking Needs. The accumulated earnings tax has been referred to as a. The Accumulated Earnings Tax The accumulated earnings tax is a penalty tax designed to dis- courage the use of a corporate umbrella for personal income.

Tion of earnings beyond the. Tax on Accumulated Earnings. Under what circumstances should a redemption of corporate stock or the funding of a proposed.

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Income Tax Computation For Corporate Taxpayers Prepared By

Test Bank Income Taxation Cpar

Darkside Of C Corporation Manay Cpa Tax And Accounting

Income Tax Computation For Corporate Taxpayers Prepared By

Income Tax Computation For Corporate Taxpayers Prepared By

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

Improperly Accumulated Earnings Mpcamaso Associates

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Income Tax Computation For Corporate Taxpayers Prepared By

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Income Tax Computation For Corporate Taxpayers Prepared By

369113203 Income Taxation Quizzer Pre Week Quizzer Instruction Select The Best Answer To Each Of Studocu

Income Tax Computation For Corporate Taxpayers Prepared By

Cares Act Implications On Corporate Earnings And Profits E P

The Income Tax Rate Of Corporations Lowered In The Philippines Lawyers In The Philippines